Questions & Answers

The Nordic CCM project publish questions (and answers to them). Questions during stakeholder meetings are published as part of the meeting notes, available under Stakeholder meeting material. The other questions, for instance by e-mail, are published here. To post new questions, please email ccm@nordic-rcc.net.

For the abbreviations used, please see the List of abbreviations.

Questions 2023-2024

Please note that the questions and answers below are arranged from newer to older.

Questions answered in 2024

We are interested in running some calculations of ATCE with alternative weighting of interconnectors to see the impact on capacities. I am wondering which solver you use considering non-linear objective function?

Answer provided 28 June

IPOPT can be a good option. if you develop the scripts in Python, you may try CVXPY Clarabel Interior Point solver. Please refer to the description here: https://www.cvxpy.org/tutorial/solvers/index.html

If a HVDC connection has reduced capacity to for example 330 MW caused by maintenance, and the 330 MW is fully used in the NTC algorithm - can you, in certain cases, use more than 330 MW in the FB algorithm?

Answer provided 27 June

Answer provided 27 June

This questions is regarding not having neighboring TSOs (external border) limitations as part of the model. When are these limitations known to Nordic TSOs during the day? When can the new ATCE process take these limitations into account and the ATCE process be re-run to open up for some more internal Nordic Intraday initial capacity and trading? Reason for it is that not adjusting for external border limits that neighboring TSOs would set obviously are reserving capacity in the Nordic system that as a consequence can never can be used based on computed internal Nordic initial ATCE without considering those external limits.

Answer provided 27 June

For go-live, the Nordic RCC will only produce one ATCE calculation, which will be without any external TSO limitations. This calculations is performed when the TSOs only know their own limitations. Updating the ATCE calculations to consider the external capacities is not currently planned in a future release. The reason of not considering the external limitations comes from the cross-CCR capacity calculation process. It is a consequence of having multiple CCRs in Europe. The external limitations are provided after the Nordic TSOs calculate the ATCE results. In other words, the Nordic TSOs compute the ID ATCs (of the external borders, i.e. HVDCs in SE4, NO4, DK1, etc) based on the Nordic grid constraints. The external TSOs compute the external border capacities based on their grid constraints. Both ID ATC results are provided to the ID trading platform. The smaller external border capacity prevails. The current process does not facilitate the Nordic TSOs to wait for the external TSOs’ inputs on the external borders and optimize the Nordic internal borders based on internal Nordic grids and the external limitations.

Answer provided 27 June

The relevant data have been published. We would like to invite the stakeholders to perform customized analyses.

Can the TSOs provide Increased and/or Decreased trading space quantified in numbers per BZs, also taking into account bordering TSOs limitations as this is not done today.

Answer provided 27 June

Can the TSOs provide, similar to the green graphs on a per border basis, todays ATCs and flow for comparison, now the two setups are hard to compare as the current values are only graphically available in the duration curves.

Answer provided 27 June

I wonder if it possible to publish the values for GSKs used in the domain calculations. Could you please add this to the to-do-list if so?

Answer provided 18 June

Answer provided 13 June

What kind of limitations are captured on the external borders from neighboring TSOs, in latest ATCE proposal versus “Current method”? If we have understood your information correctly the lack of possibilities to capture these external border limitations (i.e. for all CZ border interconnectors between continental EU and the Nordics) in latest ATCE proposal is making all comparison on all External borders very skewed towards the ATCE proposal as we understand what is shown as current method is including external border TSOs limitations but ATCE proposal is not. What are TSOs steps to make these fair and comparable, and when can this be implemented? If ATCE proposal values can’t be adjusted, can TSOs show Current graph before other TSOs adjust the values in addition to what is available today? At least that should be available in addition and make the different setups more comparable.

Answer provided 6 June

ATCE results published under EPR does not include limitations from external (non-Nordic) TSOs. The reference data from ENTSO-e transparency platform does however include these limitations, which somewhat skews the comparison in favor of the ATCE results. The effect is however only present on bidding zone borders towards external CCRs. Alternative sources of reference data could be provided in a way such that external limitations are excluded. However, this requires a complex merge of data from different sources, some of which are not publicly accessible and with varying quality. In the end Nordic TSOs have agreed to use the data from transparency platform both to keep the reporting simple and to enhance transparency around the data sources. A disclaimer regarding the external limitations is stated in the EPR publication handbook.

We today lack the pedagogical coupling in TSOs provided numbers and slides on ATCE proposal and the rest of the EPR process, including walkthroughs related to Day-ahead EPRs in comparison to the relatively little information available on ATCE proposal. These DA and ID markets are inherently connected and it would be helpful if they could be handled in the same process when presented in stakeholder meetings and with a clear link created to explain also market situations impact on the outcome from the ATCE proposal given different market situations, e.g. known fundamentals before SDAC GCT and different fundamentals realized before start of SIDC market for tomorrow or during the time SIDC trading is open until minimum one hour before delivery period.

Answer provided 6 June

As the starting point for the internal aligned process, the TSOs that are responsible for the DA market elaboration are also responsible for ID part. In the coming months, we aim to synchronize more on the content level to elaborate the same MTUs on both DA and ID. The results will be presented during the same monthly SH event, starting from 13/06. Also, the EPR operational learning point document will contain the DA and ID sections from the next release.

Can the TSOs provide transparency on the parameters used in the calculations, per border or BZ where relevant.

Answer provided 27 June

Please explain clearly the differences between SE3-SE4, SE3_AC-SE4_AC and SE3-SWL-SE3_SWL as a disclaimer in the results from the ATCE proposal.

Answer provided 27 June

Are new ATCs from the ATCE proposal results shifted towards the Norwegian borders? At least that looks like to be the case on several interconnectors, and we wonder if Nordic TSOs share this observation? Same observation between bigger connections losing on behalf of smaller ones? Did TSOs take into account current trading patterns, and liquidity and trading per bidding zone in the intraday markets today when creating the proposal?

Answer provided 27 June

The TSOs assume the question is related to the current ID ATC vs. new ATCE results. We preliminarily observed that the reduction of Swedish ID ATCs in the ATCE results beome larger comparing to the reduction on the NO borders as a qualitative way. The reduction of the SE ID ATC is partly due to the current ID ATC not being operationally secure if fully allocated. The NO2 BZ with cables out of the CCR Nordic is larger in ATCE, due to the ATCE only considering the Nordic grid limitations. The ATCE method does not consider any weighting factors.

We note that TSOs have started to publish values and graphs from the ATCE proposal but no impact analysis of these changes in the proposal, therefore can TSOs explain what analysis has been done by each TSO in this area? For example, how will the new ATCE proposal change trading in the intraday timeframe compared to today’s situation? One idea could be that TSOs summarize ID usage of cross border flow today for ID timeframe on all external and internal Nordic borders and analyze how much of this trading would be possible under the new ATCE proposal. Also worth to evaluate what is the value (or rather opportunity cost or welfare loss) of ID trades that can’t take place due to ATCE proposal limits?

Answer provided 27 June

The request of comparing the currently realized ID trades and the ATCE ID ATC capacity is addressed in the General trends of ATCE results presentation during the ID SH event on June 10. For specific hours of interest, the TSOs also analyzed and presented 3 cases in this presentation from the same event. The TSOs expect that the ID trades in the current NTC world might be different from the FB world. For other analysis, the TSOs encourge the SHs to dive into details with all published data on the NRCC website and the ENTSO-E Transparency Platform. To faciliate the SH's understanding, the TSOs are in contact with the SwedEnergy to discuss the hub-to-hub ID analysis. We will inform the SHs as soon as the material is available.

The ATCE methodology and implementation is further detailed in the document: “Transitional solution for calculation and allocation of intraday cross-zonal capacities for continuous trading in the Intraday timeframe”. The current version of the f, g and h functions are captured in this document, if any. To be specific, f is applied in the objective function of border multiplication. g is not applied. h is not applied.

What are the needed planned remedial actions to support calculated ATCs per TSOs and per BZ and CZ Borders to support the calculated ATCs under the new ATCE proposal? Can this data be presented from each TSO, per BZs to understand that TSOs also include this regulatory obligation when providing initial intraday capacities based on ATCE?

Answer provided 27 June

There are two types of remedial actions, preventive and curative RAs. The TSOs provide and publish the preventive RAs in terms of MW in the DA FB CC. They are already reflected in the DA FB domain and the subsequent the ATCE results. Curative RAs, in general, are not part of the RAs in the FB CC process.

Answer provided 27 June

Why is some of the old ATCE data removed from publication, but not all? Can TSOs provide a numerical overview on MTU-level and summarized to for example weekly level on a per border basis between the old and new ATCE proposals? (we know TSOs have done this comparison but it would be fair to show the updates applied) Reason for asking is that it looks like a lot more then just overloads have disappeared in the updated ATCE compared to what has been published as ATCE over the entire EPR period and it being important to explain the key fundamentals creating overall situation.

Answer provided 6 June

Values coming from the ATCE proposal are perceived as very fluctuating compared to intraday capacities today that are much more stable and often directly linked to the day-ahead flow results. Do the Nordic TSOs share this observation and can something be done in relation to the predictability and stability of the ID ATCE capacities?

Answer provided 6 June

The TSOs share this observation and concern with the fluctuating values. It must be acknowledged that there is a trade-off between providing the largest possible amount of capacity for any MTU and reducing the volatility of the capacities. Currently, TSOs are committed to providing maximum available capacity, in accordance with the 2019 Clean Energy Package.

Have TSOs considered how the ATCE proposal will impact coming IDAs as they will start with current setup but transition to the ATCE proposal at go live of FB? Are TSOs considering to quantify the SEW from for example IDA1-3 under both todays capacities and the ones coming from the ATCE proposal. This would be a way to at least partially understand the SEW impact from changed setup on intraday capacities.

Answer provided 6 June

Unfortunately, there is no option of simulating IDAs in the market simulation tools used during EPR. The Nordic TSOs are not aware of any tool with such capability.

Have TSOs looked into the impact on both markets participants possibility to trade themselves in balance given at least for some of the most important areas for today’s ID market? Will current ATCE proposal increase the need to handle imbalances locally and via special TSO trades, this is our understanding looking in the impact from the provided ATCs from ATCE proposal but we are interested to understand TSO analysis on this topic. Would the ATCE proposal create a need to increase the procured TSOs reserves, if so in what areas and at what additional cost (e.g. welfare loss) versus today?

Answer provided 6 June

The balancing needs topics are being investigated by the Nordic balancing model project. The CCM project will further align with the NBM project and provide more information to the SHs.

Answer provided

Skagerrak and Kontiskan are in the zip-files for historical data. The names of those borders are: DK1-NO2 and NO2-DK1 (Skagerrak), and DK1-SE3 and SE3-DK1 (Kontiskan). The Baltic cable is not part of the ID market, so that is why that border is not present.

Answer provided

Answer provided

SE4-DE is the Baltic cable, which is not subject to the ID trade at this stage. The TSOs are applying the ATCE methodology on the NO4-FI and the Baltic cable the same way as other ID borders. These two borders are currently don’t have the possibility to utilize that capacity allocated to them.

For the objective function for SE3<->FI, is only the capacity of FS included or is there also a part for the DC flow? Easiest if you just show this part of the formula, please.

Answer provided

In the objective function, FennoSkan is represented by 'extracted' NTC between SE3 amd FI. Its z2zPTDF of FI-SE3 is computed by "z2zPTDF of FI->FI_FennoSkan + z2zPTDF of SE3_FennoSkan->SE3"

For optimisation variables for SE3<->SE4, what is included objective function? Is it (SE3-SE4_AC + SE4-SE3_AC) * (SE3-SE4_SWL + SE4-SE3_SWL) or is it (SE3-SE4_AC + SE3-SE4_SWL + SE4-SE3_AC + SE4-SE3_SWL) or something else? If something else, please show the formula.

Answer provided

(SE3-SE4_AC + SE4-SE3_AC) * (SE3-SE4_SWL + SE4-SE3_SWL)

Answer provided

Answer provided

Now back to question about remedial action in the basecase. The word “redispatch” indicates to me that there is a basecase dispatch and that dispatch is changed. However, in basecase we have the basecase dispatch. This contradictory to me, since we cannot at the same time have the basecase dispatch and redispatch from the basecase dispatch. So, should I then interpret this as a pre-dispatch, basically the TSO has ordered a specific generator to produce regardless of price outcome? Right/wrong? If there is a pre-dispatch of some generators in basecase, are the GSKs used for calculation this CNEC the same as for all other CNECs in the basecase? I am not expert on UMMs, but I have seen UMMs for example where Energinet has ordered thermal generators to run. If this is the same thing, should I expect to find UMMs in case of pre-dispatch of generators?

Answer provided

Calculation for contingency with remedial action. In your answer you mentioned redispatch as the remedial action the TSOs use. In this case the dispatch will be different from the basecase dispatch. Thus, not only the network configuration needs to be changed. Also the GSKs need to change, since the dispatch in this case is different from the basecase dispatch. Right/wrong?

Answer provided

GSK strategies do not change. Remedial actions are calculated by TSOs and supplied as actual MW values for each CNEC. How this is implemented could differ between TSOs. In general a typical way could be that the TSO would apply the full contingency and remedial actions to their IGM and do a loadflow calculation to determine the relieving effect to a CNEC and thereby determine what RA value is can be set for CNECs with remedial actions. The RA values are the ones published. Typically, TSOs provide effect of non-costly (e.g. topology changes) RAs in the capacity calculation. The TSOs approach to RA values can be found in the JAO publication handbook. It is also noted in “Operational learning points” that countertrade for SE2>SE3 in FB will be implemented when such an implementation has reached a satisfactory level of development quality, but is not expected to be ready before FB go-live. However, in theory it will follow the same principle as above, where the affect of countertrade is provided by TSOs as a RA MW-value to increase RAM.

Calculation for contingency with no remedial action, when the contingency is generator. This time, no line or transformer is removed. However, since a generator is out compared to the basecase, GSKs need to be changed, due to that the dispatch is now changed compared to basecase dispatch. Right/wrong?

Answer provided

In case of a generator contingency GSK strategies would still remain the same, and therefore GSK factors and the resulting GSK factors and PTDFs would not differ significantly, in theory. If the generator is large enough or the number of generators in an area is small it may impact resulting PTDFs, considering that its change in production would not be included when computing PTDFs for the CNEC. The outage would also affect the flow in lines when computing F0 (flow at zero netposition), which would impact the RAM result supplied to the market. There is also a form slack handling that should mimic the FCR/FRR which also mainly affects the F0 and to some (probably minor) extent affects the ptdf:s. In general, a generator outage can affect the calculated RAM more, but it would have limited impact on PTDFs as only small changes in flows are created when computing PTDFs.

Calculation for continency with no remedial action, when the contingency is a line or transformer. One network element and its impedance is removed and the calculation above is repeated with the unchanged impedances for the rest of the network elements and unchanged GSKs. Right/wrong?

Answer provided

Correct. Contingencies are applied as per CNEC definitions and PTDF-values are computed for that CNEC. For CNEs, PTDFs used are those computed directly from the base case.

Calculation for basecase. In order to calculate the PTDFs for the basecase we need the network configuration without contingencies, the impedances of the network elements and the GSKs, right/wrong? To get the GSKs we need to make an assumption about the dispatch of the generators, right/wrong? Let’s call this dispatch assumption basecase dispatch. With this information, PTDFs for the basecase is calculated for all network elements, but only a fraction is published. Right/wrong?

Answer provided

In case of unplanned outages, there are remedial actions for some contingencies. Basically, something unplanned happened and action is taken to mitigate this, right? My question is if this action is also accounted for in PTDFs? The outages itself will of course impact the PTDFs, since the network configuration is changed. I suppose that a remedial action could change how the area net position is distributed between the buses and/or change the network configuration more than just the outage. If so, is that included in PTDFs? Hence, it would wrong to assume that the only change to PTDFs in case of an outage is the changed network configuration due to outage. Could you please elaborate? I guess for IVA the PTDFs are not recalculated. But, please correct me if I am wrong.

Answer provided

Answer provided

We have seen the update regarding the encountered problems with the new ATCE computations, and would just like to confirm whether the results that have been published for week one through six are based on the old or the new method?

Answer provided

At Energinet.dk there is information from 2020 about buses, lines, transformers including network configuration, impedance data for lines and nominal power and short circuit voltage for transformers. Do you know if there is this kind of information sources for other countries?

Answer provided

We unfortunately do not provide any of that data on our websites or platforms. The data we have available for sharing is what is already published on JAO and our own website already. Statnett has some network data available for download through NVE data nedlast, but there is to our knowledge no similar data avilable from SvK or FG. I would recommend either searching on the TSOs own websites or contacting their respective departments directly.

Answer provided

The simulations show that Nordic flow-based will enable higher exports to the continent. However, the largest effect of implementing Nordic flow-based occurs inside the Nordic Region, where more electricity can be moved from north to south. The results from our simulation can be found on the RCC website: https://nordic-rcc.net/flow-based/simulation-results/

Answer provided

Answer provided

Indeed the borders you mention are missing from the ATCE results. This is a mistake that we have unfortunately not noticed before now. We will make sure these borders are added going forwards. Furthermore, we will ensure that these borders are included in the re-calculation that we have anyway planned for the previous weeks, due to changes to the relaxation parameters used in EPR.

Answer provided

Thank you very much for reaching out and pointing out the publication issue. The issue has been resolved and the missing data are now published.

Answer provided

Indeed the observations by the requester are correct. The CNECs are defined only in positive direction. This means that if there is a need to limit market coupling flows in both directions of a network element, the TSOs will define two CNECs – one for each direction.

I am curious if the implementation of the Nordic FB will lead to running JAO auctions for the interconnector capacities between Nordic countries. If this is the case, do you have a timeline for these auctions?

Answer provided

The only interconnector between the Nordic Bidding Zones where there are LTTR auctions at JAO are DK1-DK2. Currently it is not foreseen to be additional borders where LTTRs will be auctioned. Introducing auctions at JAO as a fallback for DA auctions is not foreseen either

I was told in a bi-weekly meeting that I could find aggregated SEW results in the website. Are they available in excel format somewhere, or only in pdf format (i.e. in the market report)? I would like to analyze the SEW result as a time series per bidding zone.

Answer provided

Data on social economic welfare (SEW) are available in aggregated from per week per bidding zone in the market report and are also presented in graphs in the appendix. However, these data are not available at MTU level in excel format.

Answer provided

Thank you for notifying us about the typo. We will alert our Energinet colleagues about the issue so that it can be resolved.

Answer provided 20 March

Regarding the data publication regarding the long-term timeframe, please refer to the presentation: NUCS LT

Regarding the data publication during the EPR and after go-live, please refer to the presentation: Data publication in EPR and after go-live

Are there any aspects of the RAM calculation that you think you may do differently to other TSOs? How do you set the FRM (flow for reliability margin)?

Answer provided 20 March

The mFRR EAM allocation uses the remaining CZC after ID market. Thus, the resolution CZC depends on ID market resolution.

We will have a unique capacity calculation for each one-hour MTU. This capacity is mapped to each 15 min timeslot within the hourly MTU; this capacity will be impacted by the allocation within the 15 min timeframe.

Are there any aspects of the RAM calculation that you think you may do differently to other TSOs? How do you set the FRM (flow for reliability margin)?

Answer provided 19 February

Most parts of the RAM calculation is done commonly at the Nordic RCC. The part where the TSO:s have an effect on the RAM is:

- The selection of Fmax: Typically TATL values for N-1 CNEC:s and PATL values for N-0 CNEC:s

- RA-value: Calculated internally by TSO:s

- FRM: During EPR FRM is currently set to 5% for all CNEC:s accept for Allocation Constraints (HVDC-capacities) where FRM is set to 0%. Note: FRM on SE1-FI border (FI_PTC_RAC CNECs) has been set 0% (of Fmax) and 100 MW has been taken into account by decreasing Fmax with 100 MW (as it was not possible to have MW value for FRM in FB solution).

CACM-Nordic-CCR-DA-and-ID-CCM-2020-1.pdf (nordic-rcc.net)

The TSOs shall perform the calculation of the RM regularly and at least once a year applying the latest information, for the same period of analysis for the RM and FCR margins, on the probability distribution of the deviations between expected power flows at the time of capacity calculation and realized power flows in real time.

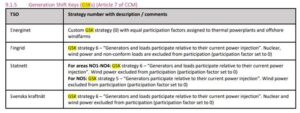

How are the Generation Shift Keys that you use defined and what process has been used to determine the preferred structure/parameters?

Answer provided 19 February

The Nordics have chosen to implement AHC (some Nordic HVDC-connections are not part of the common European DA auction and they are handled slightly differently).

Methodology and concepts for the Nordic Flow Based Market Coupling (nordic-rsc.net):

"Advanced Hybrid Coupling" The term "hybrid coupling" refers to the integration of the two capacity calculation methodologies, the CNTC and the FB approach.

Power flows on HVDC interconnections are by nature fully manageable, and a radial AC transmission grid has no meshed structure for the power to fan out. Thus, in a pure HVDC network, or in a radial AC transmission grid, both the CNTC and FB perception of the power flows corresponds fully to the real physics of the power system. However, in a meshed AC network, the FB (or nodal) approach is the only one of the two which is able to manage real physical power flows.

In the Nordic countries, all interconnections to adjacent synchronous areas are either HVDC or radial interconnections. These parts of the Nordic transmission grid area by definition a physical embodiment of CNTC, and it doesn't make sense to implement an FB approach on these parts of the transmission grid (an FB approach would anyhow behave as a CNTC approach). With this realization in mind, the Nordic CCM have to apply a hybrid coupling to integrate the HVDC and radial AC interconnections in the meshed AC grid.

The "hybrid coupling" might be either the standard hybrid coupling (SHC) or the advanced hybrid coupling (AHC). Before entering into the explanation of SHC and AHC, it is important to bear in mind that when the power flows from an HVDC or a radial AC interconnection enters the meshed AC transmission grid, the power flow will fan out in the AC transmission grid and use the scarce transmission capacity like all other power flows in the transmission grid.

The distinction between SHC and AHC is the difference in how power flows coming from a radial AC or HVDC interconnection are managed by the market coupling in the meshed AC transmission grid. On a high level, the SHC is granting priority access in the meshed AC transmission grid for power flows coming from a radial AC or a HVDC interconnection, while in the AHC, these power flows are subjected to competition for transmission capacity with all other power flows in the transmission system.

In the rest of this chapter, the term HVDC interconnection means both radial AC and HVDC interconnections. Both SHC and AHC are based on CGMs. In SHC, an expected flow on the HVDC interconnection is at first calculated for the base case net positions. In order to guarantee the estimated power flow on HVDC interconnection, the resulting power flows in the meshed AC grid must be granted priority access on the relevant grid limitations. This can be done by applying the nodal PTDF matrix on all limiting CNEs from the "access point node" of the relevant HVDC interconnection to calculate the amount of MWs the estimated HVDC flow puts on all CNEs in the meshed AC power system. The calculated amount of MW for each CNE is removed from the relevant RAMs to make room for the estimated flow from the HVDC interconnection. The adjusted RAMs are provided for allocation to the market coupling for all other power flows.

If the realized HVDC power flow falls below the estimated power flow, the SHC process might thus leave "unused" transmission capacity on CNEs, even with excess demand for that transmission capacity by other power flows. The SHC is by the same mechanism neither able to optimize the distribution of transmission capacity between different HVDC interconnections or between HVDC interconnections and other potential efficient power flows in the system. Thus, the SHC is clearly not able to ensure optimal use of transmission infrastructure.

In the AHC, the nodal PTDFs from the "access point node" is provided directly to the market coupling for allocation, and the RAMs for the affected CNEs in the AC transmission grid are left intact without reductions caused by the HVDC power flows. The "access point node" is established as a "virtual bidding zone" in the market coupling. This "virtual bidding zone", which is a bidding zone without any orders from market participants, is "only seen" by the market coupling during capacity allocation, in the sense it will obtain a unique price in the market equilibrium, while the actual power traded on the HVDC, will receiving the market price of in the surrounding bidding zone. In the AHC, each HVDC interconnection is provided with its own virtual bidding zone with unique PTDFs.

With the AHC, the power flows from the HVDC interconnections become a part of the FB approach within a CCR, and are thus treated as all other power flows in competing for transmission capacity. Transmission capacity in the meshed AC grid will be assigned for the power flows from each individual HVDC interconnection due to price differences and impact on CNEs in the AC transmission grid based on the competitiveness of the power flows coming from the individual HVDC interconnection.

By utilizing the AHC, there is no priority for HVDC power flows on any interconnection, and by utilizing the market coupling, the allocation of power flows between different HVDC interconnections will be optimized, as will the allocation of power flows between HVDC interconnections and all other power flows in the power system. This leaves no unused transmission capacity with excess demand. The AHC is thus a more flexible approach than the SHC in managing power flows on/from HVDC interconnections in the meshed AC transmission grid, and also the welfare economic more efficient congestion management approach.

How are the Generation Shift Keys that you use defined and what process has been used to determine the preferred structure/parameters?

Answer provided 19 February

In the earlier stages of the flow-based method project, various strategies were evaluated to find the strategies resulting in the lowest modeling error. According to the Nordic method for capacity calculation, the GSK strategy should be evaluated at least annually, which will be done after the method is implemented, and updates to the Flow Reliability Margin (FRM) based on observed deviations can be carried out.

The following strategies are currently used by the Nordic TSO:s

Nordic_PublicationTool_Handbook_v0.2.pdf (jao.eu):

When flow-based is implemented in the day-ahead market, what process will be used to define intraday ATCs?

Answer provided 19 February

After the Day ahead market outcome, Nordic RCC will use an optimization algorithm to extract intraday capacities around the market outcome inside the FB-domain.

A description of the ATCE-method can be found here:

Methodology and concepts for the Nordic Flow Based Market Coupling (nordic-rcc.net) (methodology)

PowerPoint Presentation (nordic-rcc.net) (presentation

What process is being used to define Critical Network Elements for your network? What process is being used to define Contingencies for your network?

Answer provided 19 February

Among the Nordic TSO:s the CNE:s and contingencies are qualitatively chosen from the monitored elements and contingencies used in the security analysis to ensure secure operation based on manual experience.

When the Nordic FB-domain is created there is a check to see if a CNEC has no zone-to-zone PTDF equal or greater than 5%. The CNEC:s that meet this requirement are then flagged as being insignificant and are disregarded from the market optimization.

Nordic_PublicationTool_Handbook_v0.2.pdf (jao.eu):

Significant – “True”: The constraint has been considered in flow-based parameters calculation. “False”: The constraint has been disregarded in the flow-based parameters calculation. CNEC significance is determined by evaluating the magnitude of the difference between smallest and larges zone- - 9 - slack PTDF for the CNEC in question. CNECs for which the difference is smaller than the PTDF significance threshold are ignored in flow-based parameters calculation, as they have insignificant impact on cross-border exchange. The CNEC significance threshold is defined by the Nordic TSOs, but must at least be 0.05 as per the Nordic Capacity Calculation Method.

Answer provided 2 February

With FB the grid is described in more detail than in NTC, which results in a larger solution domain. This allows the market algorithm to utilize the grid more efficiently, thus increasing the total socio-economic welfare in the system. With the larger domain the flows between bidding zone can increase, which reduces price difference between bidding zones. This is in line with the results from the EPR simulations, where in general the highest price bidding zones have seen price decreases compared to NTC due to larger flows from the low-price bidding zones. As a result, the price generally increases in the bidding zones with lowest price. Depending on the market situation, the low-price and high-price areas as well as the level of convergence might change.

Answer provided 2 February

The answer depends on how price spikes are defined. If defined as a situation where a single bidding zone stands out in terms of significantly larger prices than the other neighboring zones, these prices should be lower with FB, considering that FB will provide a solution domain larger than that in NTC. This would cause more power to flow to that area in order to increase the total welfare of the system. However, price spikes do occur in both FB and NTC, and no major change in magnitude and occurrence between the two methods has been noted during the parallel run.

Answer provided 2 February

Nordic TSOs are providing network matrixes and critical network elements for which market participants can create their price forecasting models.

Yearly (Y-1) network matrixes and critical network elements enable creating price forecasting model. This model is currently being developed and to be ready for LT FB external parallel run (LT FB go-live is 6 mo. after DA FB go-live at the latest). Current parallel runs use D-2 models for daily day-ahead market coupling which can be used for modelling, however these represents next day´s network and its constraints.

Answer provided 2 February

Nordic TSOs are providing network matrixes and critical network elements for which market participants can create their price forecasting models.

Yearly (Y-1) network matrixes and critical network elements enable creating price forecasting model. This model is currently being developed and to be ready for LT FB external parallel run (LT FB go-live is 6 mo. after DA FB go-live at the latest). Current parallel runs use D-2 models for daily day-ahead market coupling which can be used for modelling, however these represents next day´s network and its constraints.

Answer provided 2 February

Generally, the advantage of flow-based is its ability to utilize the grid in constraining situations. There is no clear seasonal trend, but flow-based has a larger impact during high-price and higher price differences (such as the winter of 2022/2023), and less during low-price and lower price differences (such as July of 2023)

In both NTC and FB, the prices are generally higher in the winter, and lower in the summer. We also see more value of additional flow in flow-based during the winter-time, indicating that NTC operates outside the operational security more during constraining periods. As long as the CNECs the TSOs send to the market are correct, flow-based will stay within operational security.

There is more congestion income during the winter, as there are higher flows and more price differences during the winter.

I have looked again through the data book you regularly provide, this time MarketResults_Week50_52.xls.xlsx. In the sheet “Pivot ScheduledExchange” I selected NO3->SE2 and saw following graph (with MTU also enabled on the X-Axis):

Is there a reason why it is always negative?

Adding the NTC Domain in the graph I have the impression that FB might have an offset / shift downwards; Is there a reason for that or is it a misinterpretation?

Answer provided 29 January

The schedule exchange data is directionally determined, so in this case it is negative because the SEC are in direction from SE2->NO3.

Below is the description of the scheduled exchanges from the market result file:

Contains the electricity transfer scheduled between neighboring bidding zones on the cross borders.

Scheduled exchange calculation (SEC) uses a SDAC algorithm ‘volume indeterminacy’ feature based on DA Scheduled Exchanges Calculation Methodology.

The SEC differ from the flow actual allocated by flow based (F_AAC). The TSO recommend to the use the F_AAC value.

Due to the losses considered for the Skagerrak connection, two scheduled exchanges are used to represent the exchange between DK1 and NO2. (DK1->DK1SK and NO2SK->NO2).

The SEC for a FB solution does not take the border limitation into account, so it allocates the flow on the shorts path without looking at the limitations. As stated in the description, the TSO:s recommend stakeholders to use the F_AAC values instead as these represent the expected flow in the system and reflect the optimization done by the day-ahead algorithm Euphemia for the Nordic FB domain.

I have been trying to construct a flow-based model with the data from JAO. After studying the ptdf’s, I have observed that the DK1_DE has no impact on the CNEC’s, as the ptdf is zero in all cases except for the allocation constraint. Why is it that the ptdf of DK1_DE is zero?

Answer provided 29 January

PTDF values on JAO are zone-to-slack values, where the slack node in the balancing area DK1 is located at the DE-DK1 border. If you want to know the impact of a flow on the DK1-DE border, you should look at the zone-to-zone PTDF values between the VBZ DK1_DE and the BZ DK1.

For further explanation of the slack node, please refer to slide 17 in the presentation “FB methodology pedagogical walkthrough” (from the Nordic CCM stakeholder meeting 17 March 2022). The presentation is available for download under Flow-based at the Nordic RCC website: https://nordic-rcc.net/wp-content/uploads/2022/03/2.-FB-methodology-pedagogical-walkthrough.pdf

Are there any documents explaining how to calculate the net positions, other than in the Q&A section?

Answer provided 29 January

Yes, there is an explanation in the JAO handbook, section 6.5. The JAO handbook is available for download at the JAO publication tool website: https://test-publicationtool.jao.eu/PublicationHandbook/Nordic_PublicationTool_Handbook_v0.2.pdf

We previously thought that due to the implementation of advanced hybrid coupling neighbouring interconnectors can also experience non-intuitive flows and this has also been published accordingly in your reports where interconnectors like Baltic Cable were shown to have some hours where non-intuitive flows occurred. After studying the minutes of the last stakeholder meeting on 26 October, this is not so clear anymore.

The minutes under section 4 read : “The flows on those HVDC borders can change as a result of Nordic FB (but it doesn't mean that there will be non-intuitive flow on those borders as a result of Nordic Fb I believe). I imagine there may be: a virtual area is modelled as a Nordic bidding zone, and from here an "intuitive" flow will be scheduled to the connected Baltic region. But if the price of the virtual area is not use, but instead the price of the "real" Nordic bidding zone is used, the non-intuitive properties that inherently exist under FB may also propagate on the Baltic HVDCs Thanks for the update on the modelling! Has anyone from the TSOs looked into if counter-intuitive flow are present/possible on borders to BZ´s adjacent?

CCM: we will get back to you”

Could you shed some light on this topic and clarify the intended behaviour from go-live? - Can you help me understand what happens for the ID timeframe, if the FB in DAM results in non-intuitive flows for an HVDC interconnector? Will you pull an ID stop in order to avoid trading in the opposite but “bilaterally right” direction? To be very concrete, say you have an interconnector which has an NTC of 600MW and gets allocated a non-intuitive flow of 600MW in the day-ahead auction. What would be the ATC in this case for the opening of intraday in the direction that is opposite to the non-intuitive flow?

Answer provided 29 January

DA: Flow-based can lead to a non-intuitive flow on the borders between a Nordic bidding area and the neighboring area outside the Nordic. This has been observed in EPR; however, most cases with non-intuitive flows on the Hansa/Baltic borders occurs due to ramping or other allocation constraints which is also present today. It’s essential to note that EPR is not a forecast of the future, but rather a comparison of two capacity calculation methodologies – FB and NTC. The CCM project does not anticipate an increase in non-intuitive flow increases compared to EPR after go-live.

Non-intuitive flow will result in a negative congestion income, but ACERs Decision No 16-2023 addresses the issue on congestion income distribution between CCRs.

ID: the ID ATC is computed by the ATCE method that is currently being further enhanced at the TSOs. The direct outcome of the ATCE method is the extracted NTC, denoted as 'NTC_initial'. The 'NTC_initial' is subject for the TSO validation, considering the operational aspects, resulting to the final extracted NTC, denoted as 'NTC_final'. The 'ID ATC' is computed by 'NTC_final' - 'DA AAC'. During the EPR, the 'NTC_initial' is equal to 'NTC_final' due to the 2-week of the grace period. After CCM go-live, the TSOs will further assess the operational needs to adjust the NTC_final where needed, e.g. new outage occurred between the DA market outcome and the ID gate opening and the TSOs can assess the impact during the ID validation window.

With the go-live of the Viking DC interconnector between UK and DK1 end of year I was wondering if, how and when this is going to be integrated into the Nordic FB methodology and specifically into the external parallel run? There will be a new single virtual zone representing this cable, correct?

Answer provided 11 January

Viking Link is modeled outside the SDAC market and the flow on Viking Link is determined through a separate auction before the market coupling auction. Viking Link is modeled as independent load/production in the grid model and is represented as part of the F0-flow in the FB-domain. Therefore, a virtual bidding zone will therefore not represent Viking Link in the FB domain. The North Sea Link (NSL) is modeled with the same approach. Viking Link was included in the EPR FB domain when it went live on the 29 December 2023.

When can we expect that the new model for the ID capacities to be presented? And when do you expect to present all the recalculated ID capacities for the whole EPR period?

Answer provided 11 January

The update on the ATCE parameter work is in progress. Please kindly note that the TSOs need to adapt the current ATCE industrial tool to verify the updated ATCE parameters before sharing the numerical outcome (based on the updated parameters) with the stakeholders. We will keep you posted.

General questions answered in 2023

I was wondering about the section “Too high capacity on NO1-NO2” in the Operational learning points report. Could you please elaborate about the effects of this in the period this has been an error? How much less flow would be reasonable on NO1-NO2 if handled correctly? What would the approximated price effect be? Increased flow from NO1 to NO2 has been a very visible difference between NTC and FB in the parallel run so far, and some more details about this would be an important learning point for stakeholders trying to prepare for FBMC.

Answer provided 22 November

As we stated on the hybrid stakeholder meeting in Stockholm 26 October, we have done deeper analyses on the flows suggested by the flow-based methodology. The flows we see seem realistic based on the simulations we have run, and do not create overloads with contingencies in the grid. The OPL will be updated to reflect this.

I have a few questions about the week 34 parallel run report. It seems to contain some irregular results that I can’t see mentioned in the comments:

- Different capacities on DK1-NO2?

- Also for FI-SE3? Maybe something strange also for FI-SE1?

- What happened with the NTC flow for SE3-SE4 – it is completely different from what we actual observed this week in the NTC market? And the flow DK2-SE4 also affected?

Answer provided 22 November 2023

1. About the NO2-DK1 situation

In NTC, the capacities on the HVDC interconnectors are manually limited either if there is a physical limitation on the cable or if there are internal grid limitations. For flow-based, the capacity is only limited if there is a physical limitation on the cable. For internal grid limitations, the flow-based methodology solves this on its own. For this week, there were limitations on Rød-Porsgrunn due to an outage. The CNEC sent to flow-based allowed for 20% overload, while not in NTC. This was probably the reason why the capacity on NO2-DK1 was higher in flow-based. We are looking into if the CNEC we sent had too high capacity, or if the NTC capacity was too limited.

2. Regarding FI-SE3

During week 34 there were outages in Sweden which restricted the flow on SE3-FI in NTC. Flowbased allowed for higher capacities for both directions (SE3>FI and FI>SE3). This was explained in more detail during the bi-weekly stakeholder meeting 28 September, please refer to the presentation (slide 20: Case Fennoskan + Outage in SE3).

3. Regarding SE3-SE4

There was a mistake in the NTC-flow results (FAAC NTC). As communicated during the Stakeholder meeting 26 October (see slide 5 in presentation), this error was present for week 31 to week 35 and has since been corrected. This error only affected the NTC results presented.

Do you provide a price comparison in the different zones that a change would have from the old system to the flow-based system?

Answer provided in October

Yes, you can find it in the CCM EPR market report appendix published weekly on the subpage Simulation Results. For example, the appendix file for week 35 can be found here. Please refer to page 11 onwards.

Also, the numerical data of required information can be found in the Excel file Market Simulation Results week 50 (2022) - xx (2023). Please note that the name of the file and the content is updated on a weekly basis. The file is available under the headline "EPR data on periods longer than a week" on the subpage Simulation Results.

When looking at RAM of PTDF constraints representing capacity on the external borders, I can see several cases that they are different from production ATCs. Could you please help me understand the cause of these differences?

The question is why when there was zero capacity in prod, in EPR there was capacity for the line (DK1-SE3, DK1-DK2)?

And for SE3-SE4 it is the other way (no capacity given in EPR, while there is full capacity in prod). Also, the question about difference in capacities when none are zero.

Answer provided in October

For the borders DK1-SE3, SE3-FI and DK1-DK2 there was internal limitations constraining the NTC domain. This was better represented with FB which allowed for higher flow on these borders.

For the SE3-SE4 case I think you have compared the wrong borders. SWL is represented in the topology as its own border and fore this period its capacity was 0. But there was capacity allocated on the AC border SE3-SE4.

The spreads out of Euphemia for 14 September were quite striking and I was expecting to check the impact of the parallel run. I was expecting especially for SE3 and SE4 significant changes in NEX and (at least visible) deltas in prices… but in fact we can hardly observe any change there.

Checking with the (excellent) tool Netto Position Nordic Flowbased Analysis - Dashboards - Grafana (boerman.dev) one would say that there would have been space to change the NEX of SE3/SE4. So in fact, to go deeper here in the details of the welfare, I would need the bid-ask per bidding zone, which I don’t have access to.

- Can you shed some lights on this day in your webinar next week or – if not possible- to publish a short explanation on hot wo interpret this one?

- Can you consider changing the way that the bid-ask are published in the Nordics? In Italy there are two way of visualizing the whole merit orders:

-

- a detailed offer list per powerplant which allows to recognize the behavior of every single unit (I know…. This is a no go for the rest of Europe.)

- The aggregated bid-ask for coupled bidding zone> which means that if all bidding zones in one hour have the same prices, then the bid-ask describe the over all merit order of the country BUT if Sicily+ Calabria decouple in one hour, then GME publishes the bid-ask describing 1) the coupled Sici+Cala area 2) the rest of Ita without those two

Maybe you guys can think of something like this? It would mean a lot in term of transparency.

Answer provided in October

For this period there was several outages in the Swedish grid that effects the capacities and flow. These can be found on the NUCS platform.

FB provides a better SEW result then NTC for this hour. We see a minor increase in the price in SE4, but a significant decrease in both FI and SE3.

The NP in SE3 is only changed with 70 MWh and this results in a price reduction of 30 EUR/MWh. This correspond to our assumption that SE3 is an area with very steep bidding curves. However there is a significant change in the flow in and out of SE3 where FB allows a higher import from SE2 and a higher export mainly to FI and SE3.

All prices, NP and buy/sell volumes on MTU and BZ level are available for both NTC and FB on the RCC website.

Regarding the publication of bidding curves on bidding zone level, that is not something that the TSOs can provide as it is data owned by the NEMOs.

As seen the net position changes quite a lot for some areas, but in the Nordics a lot of the power comes from hydro. A change in net position would mean that the hydro reservoirs would have to be filled up or emptied. An average net position change of -1600MW for NO2 for 5000hours would mean -1600MW*5000h/1e6 = -8TWh. NO2 has a reservoir capacity of 34TWh*, they would have to adjust their bidding quite a lot to not overfill their reservoirs.

Same would be true for the rest of the Norwegian areas and SE1 and SE2.

I think I saw somewhere that they did not model the North sea link (NO2-UK, 1400MW) so maybe the extreme NO2 numbers might come from there?

Answer provided in October

North Sea Link (NSL) is modeled outside the SDAC market. The flows on NSL is decided through a separate auction before the spot price is set, and is modeled as independent load/production in the common grid model. Although it is likely that the flows on NSL will affect the other flows in and out of NO2 somewhat, it is probably not enough to account for the 8 TWh of lower production/reduction in NP.

The flow-based simulation results are based on NTC bids and the bids will likely change when flow-based goes live. The producers in NO2 would probably need to reduce their water value somewhat to reflect the new capacities provided by flow-based, but to what extent is outside our scope. The reason why NO2 is impacted this heavily is probably more related to the large increase of flow from NO1 to NO2 that has been made possible in flow-based, rather than the impact from NSL.

There’s a major mismatch between the cnec names in JAO publication tool and EPR grid constraint matrix (GCM) on week 34. Practically all the anonymized cnecs have different identifiers for each source, and some other cnecs are also missing from one source. The problem is also there with cne names, and also on week 33.

This issue should be fixed, as it prevents us from validating the cnec-level results of our internal modeling vs. EPR simulations. This is key information for us as we prepare for go-live.

Answer provided 4 October 2023

Yes, the anonymization process employed on the JAO platform differs from that used for gc_matrix, resulting in distinct anonymization outcomes, as you indicated. Given competing priorities, we do not anticipate implementing a cross-referencing mechanism between the anonymization outcomes of JAO and gc_matrix at this time.

Considering publication timelines and deadlines, the TSOs offer the following guidance:

- For analyzing the most up-to-date daily FB parameters related to the DA FB market, it is recommended to utilize JAO data. This is because the energy delivery day "D" is published prior to 12:00 noon on the preceding day, denoted as "D-1."

- In preparation for the CCM g0-live during the EPR phase, TSOs advise stakeholders to rely on gc_matrix for comprehensive grid and market assessments. The gc_matrix provides cumulative weekly information including FB parameters such as PTDFs and RAM, along with market-related results such as shadow prices and market-induced flows.

I have created flow-based calculators for the Nordics but am unable to get my calculations within an acceptable margin of error using the publication tool data. I use a linear algebra solver to solve the final domain for maximizing zones and then cross-reference this against the published max NP. This results in major differences mainly for DK1, which suggests I am missing some form of constraint for the Danish zones. I already identified missing equality constraints for the virtual hubs and overall balance and added those (resulting in quite a decrease in the difference) but cant think of any more. I did notice that you publish a MaxBflow but according to the handbook that is something that is calculated, not an extra constraint. Allocation constraints on the external virtual hubs seem to be included in the final domain itself. Could one of you perhaps help me with understanding what goes wrong and why I see differences between the calculated values using the final domain and the published max boundaries?

Answer provided 4 October 2023

Yes, the MaxBflow published is a calculated value, not a constraint. The reason for the discrepancies is most likely due to the currently published results being a simplified calculation. In the handbook at JAO section 6.5 the calculation of the min/max NP is described as ‘The current version of the calculation is only a simple approach that for each bidding zone takes the minimum and maximum net position among the set of net positions which have been found to yield a minimum or maximum flow on any CNEC according to the calculation described in section 6.4.4.’

https://test-publicationtool.jao.eu/PublicationHandbook/Nordic_PublicationTool_Handbook_v0.2.pdf

This simplified calculation that does not directly work on the objective of maximizing the net position of a bidding zone. But rather it takes the largest and smallest NPs from the decision variables used in calculating max and min flows on CNECs. The simplified method is not guaranteed to return the global extremes because the same maximum flow could be realized with different configurations of bidding zone net positions. We have no explanation why the difference is more outspoken for DK1.

We have an update coming live in December where the maximum and minimum NP calculation should follow the logic given below:

- NP_max(n) <- maximize(NP(n))

- NP_min(n) <- minimize(NP(n))

Subject to the same following constraints: Constraints

Coupled pairs of virtual bidding zones include:

(DK1_SK, NO2_SK)

(DK1_KS, SE3_KS)

(DK1_SB, DK2_SB)

(SE3_SWL, SE4_SWL)

(FI_FS, SE3_FS)

Bidding zones belonging to the “Jutland” area include all zones with name beginning with “DK1” the rest are placed in Nordics.

So, the currently published min/max net positions does not serve as a particular good reference for your test. But hopefully you can recognize the above logic in your implementation.

I have questions regarding your information on an update coming in December: reiteration of earliera info. As far as I can see the allocation constraints of your listed constraint 2 are published in the final domain data set. Or is there another place where they are?

One thing I don’t fully understand is the fourth constraint that you listed. What exactly are those extra Jutland net positions? Are the DK1_* hubs something special? That could also explain why my calculations were so excessive different from the published calculation compared to the rest.

Answer provided 4 October 2023

The Jutland constraint is very important. It is essentially what keeps the balance of the entire Central European synchronous area. Spanning two synchronous areas in one capacity calculation region means that we have to split the balance constraint as such: 1 for Nordics and 1 for Jutland/Central Europe.

Allocation constraints are included among the flow-based domain parameters with type=ALLOCATION_CONSTRAINT. They have a single non-zero zone-slack PTDF of +/-1 (depending on if it is maximum or minimum net position being constrained) and RAM set equal to the constraint on net position. You can hence choose not to implement constraint number 2, as this is already satisfied by constraint number 1. But the formulation in const. 2 allows for a more efficient implementation.

Why does flow-based means a higher strain on the interconnector compared to NCC?

The TSO’s are investigating a need of ramping restrictions on Fenno-Skan when FB is implemented. What will that mean for the flows?

When will the TSO’s be ready to take a decision regarding a possible restriction?

If the restrictions is implemented – will the flows at Fenno-Skan still be higher than currently, when FB is launched?

Answer provided 4 October 2023

Based on the Nordic Flow-based parallel run results, Flow-based allocated flow between two consecutive market time units (so called ramping) have exceeded technical limitations regularly with the Fenno-Skan (FI-SE3) interconnector. Exceeding technical limitation means that HVDC interconnector cannot physically provide flow that has been allocated in the Day-ahead market. Currently ramping has been applied on HVDC interconnections from Nordic synchronous area to other synchronous areas, but not internal HVDC interconnections such as Fenno-Skan.

Assessments of ramping on Fenno-Skan are currently on-going. Fingrid and Svenska kraftnät will inform on the results of the assessment when ready.

Ramping limitation is expected to have minimal effect on Fenno-Skan average flows. The total transmission capacity will not be affected.

How will this new method of coupling the Nordic countries be expected to affect the flows to and from the continental Europe, specifically the Netherlands, Germany and Poland?

Answer provided 4 October 2023

Currently, we described in the NRA EPR report that more flows going out of the Nordic CCR, i.e. more export from Nordic to the EU continent. You can find the data for the allocated flow for each border on the Nordic RCC website. The data from the start of the external parallel run until the latest available data is continuously updated in the file called "Market Simulation Results week 50 (2022) - 31 (2023)". In the sheet "F_AAC," you will find the allocated flow in both NTC and FB for all borders and MTUs. If you want to investigate more details per border, please look into this data indicated above.

Is it simply per border, or do you count the “real” non-intuitive flows? The reason for asking is that in the recent ACER report: https://acer.europa.eu/sites/default/files/REMIT/REMIT%20Reports%20and%20Recommendations/REMIT%20Quarterly/REMITQuarterly_Q2_2023.pdf

I can see the following:

- it has a positive net position (net exporter) and

- it has a price that exceeds that of all its neighbouring bidding zones.

Is the above in line with the way Nordic RCC created the graph showing occurrence of NI-flows? Is there a standard definition of non-intuitive flow?

Answer provided 4 October 2023

The NI-flows in the market report are counted as hours per border where the AAF-flow are positive in the direction going from a high-price area to a low-price area.

We were not aware that ACER had more focus on a certain subset of NI-flow, but that is something we will have to look at. Thank you for letting us know.

I see that in EPR topology, we no longer have DK1A/NO1A/NO2A.

- Are the cumulative capacity limits for NO1-NO3 + NO1-NO5 not needed anymore (or somehow taken care of by PTDF constraints)?

- Similarly for DK1-SE3 + DK1-NO2. For the latter set of lines, currently we also have a cumulative ramping limit. How is it handled in NFB configuration?

- Similarly for SE3-NO1 + SE3-DK1

- Similarly for DE-NO2 + NL-NO2. I see in EPR data a lineset is introduced containing DE-NO2 and NL-NO2 for which cumulative ramping limits are given. These two lines are defined as NL-NO2 (Biddingarea_From = NL, Biddingarea_To = NO2), and NO2-DE (Biddingarea_From = NO2, Biddingarea_To = DE) in database, which means that the up direction of one is towards NO2 and the other is from NO2. However, in table Lineset_members, in the Direction column we have “1” for both lines, while I expect “-1” for one of the lines. Can you help me understand why?

Answer provided 4 October 2023

Please see the answer for each sub-question below.

- The cumulative capacity limits (line sets) will not be needed in the day ahead market after transitioning to flow-based market coupling. Indeed, the additional degrees of freedom given by these line sets are now redundant with the even greater degrees of freedom provided by the ptdf constraints

- Ramping limits cannot be replaced by flow-based parameters and will still be relevant after transitioning to flow-based. This is to ensure that the changes in import/export of the Nordic synchronous area can be managed with the available balancing power. Group ramping limits will still be used after flow-based go-live.

- Same as “b”

- The questions suggest that the asker has access to market simulation input data, which is not accessible to the general public. Questions from the NEMOs regarding errors in the topology configurations in the flow-based market simulations is better directed to the simulation and analysis working group for a more swift resolution. However, in this case the SIWG had it confirmed that there indeed was an error in the group ramping configurations. We thank you for the notice which led to the error being corrected for future simulations. The impact of the error on previous is estimated to be minor.

I was looking for updated information on the go life date of FBMC on your website. Would you be able to communicate the current planning?

Answer (updated 7 November 2023)

Nordic Flow-based Market Coupling is expected to go-live in October 2024. For more information, please refer to the News update on the same date.

My main problem is to understand how the time-unit in the MarketResults file for the NetPositions is set compared to the JAO website. Is the NetPositions in UTC or CET? As I understand it is in CET, as there is missing one hour 26. March? I have multiplied the PTDF’s with the NetPositions to look at the market flow and compare it with the RAM.

As for the results of my calculations I have observed that there are multiple times where NP*PTDF is bigger than the RAM. I was wondering if you have a good explanation why this occur and what the consequences are for this. I have added an example when it is an overflow of 76 MW. (Where I think I have used the time units correct, but I am not entirely sure)

Answer provided 4 October 2023

The time stamp on JAO is CET. Time stamp on net positions data and other market simulation results are Energy delivery date and MTU number. And as the MTU numbers largely follows the CET format (except for those days where we shift from summer to winter time and vice versa), the MTU number should normally match the hour of CET time stamps used on JAO.

The flow you calculate as the product between PTDFs and Net positions can be compared to the Grid Constraint Matrices that are published on a weekly basis on the NRCC homepage. The column AD “FLOW FB” should match your result.

However, it does not match for your example for the 16th of March. The most likely reason is a data inconsistency on our side. I see that we had issues on this date and that a fallback domain was published to JAO. This incident could have led to different sets of flow-based parameters were used in market simulation than what is currently showing on JAO.

If you have particular interest in this date we can try to investigate the issue more. Otherwise, I would suggest that you continue your analysis on the remaining EDDs.

Answer provided 4 October 2023

Yes, there will be ILF on these HVDCs with one terminal outside of the Nordic CCR, just like today.

Will it be possible to fetch the factors from somewhere?

Answer provided 4 October 2023

The values inherit from the NTC method. The current values can be found in the CCM EPR handbook. The revision of the ILF is out of the scope of the Nordic CCM project, depending on the approval process of the NRAs on the concerned cables.

Are virtual zone pairs modelled in the same way as the ALBE/ALDE zones for the ALEGrO Cable in the CORE flow-based domain? Specifically, the exchange between ALBE and ALDE is treated as an ATC exchange (not flow based), thus NEX_ALBE = - NEX_ALDE != 0. See also pages 7 & 8 here. I assume this would also apply for the Nordics and in analogy also for single virtual zones representing HVDC interconnectors connecting to bidding zones outside of the Nordic Flow-based topology, i.e., the NEX for such single virtual zones would correspond to the flow going / from the corresponding external bidding zone, correct?

Answer provided 4 October 2023

Virtual bidding zones are used to represent end-points of HVDC interconnectors or AC interconnectors to other (non-Nordic) regions. Some of these interconnectors (e.g. DK2-DE/LU) are part of the HANSA capacity calculation region, which performs capacity calculation by means of the ATC method (see: https://eepublicdownloads.entsoe.eu/clean-documents/nc-tasks/EBGL/FCA_A10.1_CCR%20Hansa%20-%20LT%20CCM%20-%20Legal%20document_for%20submission.pdf).

HVDC interconnectors with both terminals located within Nordic CCR are modelled as equality constraints. For example for Skagerrak HVDC connecting DK1 and NO2 we have the virtual bidding zones; DK1_SK and NO2_SK. In market coupling the net-position of those virtual bidding zones must satisfy:

NP(DK1_SK) + (1-ILF)*NP(NO2_SK) = 0 , if NO2 is exporting or

NP(NO2_SK) + (1-ILF)*NP(DK1_SK) = 0 , if DK1 is exporting

where ILF is the Implicit Loss Factor defined for the HVDC (3.0% for Skagerrak and 0 for all other internal Nordic HVDCs – values are subject to annual revisions)

Are the sum limitations implicitly included in flow-based or do they coexist with flow-based constraints?

Answer provided 4 October 2023

In the Nordic method for flow-based capacity calculation, linesets are only used for combining ramping limitations (E.g. NO2A imposes a combined ramping limit on NO2-NL and NO2-DE/LU). The ramping limits will coexist with other flow-based parameters.

While looking at JAO's data for the Nordic flow-based model, I couldn't help noticing that the only variables that are considered are net positions of all the Nordic areas and flow variables between Nordic areas and virtual bidding zones. It appears that flows between areas that are not connected by one of the lines that give rise to a virtual bidding zone are discarded. As a consequence, no CNE constraint depend, say, on any flow between Norway and Sweden, because none of these lines are associated to a virtual bidding zone. In particular, no CNE anywhere in the Nordics depends directly on any flow from and to NO1. For instance, there is a CNEC with name "Border_CNEC_SE2_NO3", but the associated PTDF coefficients show an intricate combination of many flows and net positions instead of a more natural constant vector with all its coefficients except one equal to 0. Is there a reason why the present model has been favored over a model with all existing flows between regions?

Answer provided 4 October 2023

We are not sure we understand the question so we explain the difference between a ZoneToZone-PTDF and a ZoneToSlack-PTDF in the hope that it will help. Those are two different things and can be used for different purpose. Both are available on JAO, so you don’t need to calculate them yourself.

What is a ZoneToZone-PTDF and a ZoneToSlack-PTDF?

The PTDF_BZ (ZoneToSlack) describe how the Border CNEC SE2-NO3 are affected by an increased export in BZ. E.g If the export is increased in FI with 100 MW, then it will release the flow on the Border between SE2-> NO3 with 3,286 MW. In practice does this mean that there will be a flow 3,286MW from NO3->SE2.

The PTDF_BZfrom_BZto (ZoneToZone) describe how Border CNEC SE2-NO3 are affected by a flow from BZfrom to BZto. This means an increase in export in BZfrom and a decrease of the same amount in BZto. This is calculated by PTDF_BZfrom minus PTDF_BZto = PTDF_BZfrom_BZto

Just because we increase the export in SE2 and increase the import in NO3 is there no guaranty that all the flow will be on the border SE2-NO3.

Th PTDF-value z2z_SE2-NO3 show that with export of 100MW in SE2 and import of 100 MW in NO3 will 54 MW be transformed on the border SE2-NO3. The rest 45 MW will be transported on other paths. Eg. SE2->SE1->NO4->NO3, SE2->SE3->NO1->NO3 or another way.

The ZoneToZone value is 1 if all the flow will run on that CNE.

According to the NRA-process you are supposed to deliver this data with just 2 weeks time-lag.

Answer provided 4 October 2023

Thank you very much for your patience. According to the current EPR arrangement with the NEMOs and the NRAs, there is a grace period of 2 weeks. Afterwards, the TSOs need 1 week to process and publish the data and results. So, in fact the results can be published at least 3 weeks after the energy delivery week.

However, in this case we didn’t deliver in time according to the process. After the internal checks, here are the reflections on the delay. It was caused by the reruns of the simulations of weeks 20 and 21 due to the following reasons:

- Week 20: There was an issue in the input data for week 20 (we were missing the external borders), so we created the data again and the simulations were rerun

- Week 21: 1 energy delivery day was missing in the simulation, and the max price threshold was reached due to a wrong setting. Additionally, when the TSOs asked the NEMOs to rerun the simulations, there was an issue with a session dump file that took 2-3 days to be solved.

We are constantly working on improving the data processing and publication processes and we hope to avoid the same errors in the future.

Answer provided 4 October 2023

Yes, it was due to an error in translating NorCap output to JAO input following the NorCap release 5 entering into service. The errors data published to JAO for EDDs 8 and 9th of June have now been corrected.

There are a lot of 0 for the RAM 8-9 June at JAO and it has been informed that it is due to errors.

Answer provided 4 October 2023

No, we don't expect the error to impact go-live. Although the error impacts the quality of the FB domain for these two days, the reason behind the error has been corrected.

Questions & answers in relation to the evaluation report consultation

It seems that the ATCE values are too high compared to the maximums NTC of 500 MW for this direction and 600 MW in the other direction (from PowerPoint-presentation (nordpoolgroup.com))

Answer

The physical capacity on NO2-NO5 is closer to 900 MW, but the NTC values are lower because of the consideration that some of the physical flow triggered by the trades from NO2-NO1 will fall on NO2-NO5.

The ATCE ID values make sense when looking at the PTDFs of the NO2-NO5 CNEC. When trading happens from NO2 to NO5, only 1/3 of the trade will be physically present on NO2-NO5 border CNE. So If we allow for 3500 MW ATCE trade from NO2 to NO5, only 3500/3= 1200MW will actually fall on that line. Also, a trade of 3500MW from NO2 to NO1 (this is approximately max capacity) will induce a flow of about 12% on NO2-NO5 (~400MW). So, the resulting flow from NO2 to NO5 will be around 1600 MW. This is higher than the thermal limitation on the CNEC.

In some cases, the DA FB market has ensured that around 900 MW will flow from NO5 to NO2. Thus, we can give this 3500 ATCE trading to the market, because using all this trade will result in first 900 MW change to zero, and then 900MW from NO2 to NO5. So it is possible to go from a scenario of 900 MW NO5-NO2 in DA, to 900 MW NO2-NO5 in the ID market. And to do so, you need to provide the market with ~3500MW ATCE of trade, such that the actual flow on NO2-NO5 will be 900MW.

First, the count and the percentage in the appendix reports don’t match. For example, for week 8 below, the count is 115 so the percentage should be 115/168 = 68% but the table states 34.2%. Second, it seems that the count is off. On the same week, a number of intuitive flows of 115 hours would mean that there would be more than 115 hours with higher prices in SE3 than in SE4, which is not the case. For that same week, I count 11 hours with non-intuitive flows in the direction SE3>SE4 and 6 hours in the opposite direction.

Answer

Currently the table shows both SWL and the AC border of SE3-SE4 together but they are modelled separately in FB. The market simulation outcome indicates that there are a lot of non-intuitive flows on SWL but not on the AC SE3-SE4 border and when you sum the SWL and AC flows together. The TSOs are discussing how to update the non-intuitive reporting table.

No, it is included in the FB process.

I find it strange that the five groups for 2 hours only made 21 questions. That this short answers on these 21 questions would combined all the discussions made during the 2 hours is very strange. In the light of being able to share the information to all stakeholders I find this odd. We would also like to have notes of all comments made during the session before lunch from the project and NRAs in meeting notes published.

Answer

As stated at the stakeholder meeting, we made notes of all answers that contain “new” information compared to our earlier information (for instance reports, Q&As, presentations and publications) as well as all questions related to the consultation that remained unanswered after the meeting ended. We will publish all of those, as well as stakeholder questions relating to the consultation received by e-mail during the consultation period. We haven’t been able to answer and publish all questions in one go, but we are delivering as fast as we can and aim to publish all this week. I

published one batch on Monday, another batch today and expect to publish the rest tomorrow. If we receive additional questions, we will publish them as well.

As our sessions before lunch was just presentations, we didn’t make any notes from them. We made some notes from the NRA session, but need their OK to publish, as it was their session and responses. This confirmation is currently in process and we will publish as soon as possible.

The timeline is fixed and it is not possible to extend the deadline. The consultation timeline have been shared and presented well in advance and we need to deliver to the NRAs in time.

The GSK strategies are for each TSO are published in the JAO publication handbook, section 9.1.5 at present.

The GSK factors that relate a change in bidding zone net position to a change in load or generation at a given node will not be published as it is a very large amount of data and the use case for this is not clear.

Forecast of wind and all other production and consumption estimate are used in the calculation of Fref and F0 and will therefore affect the capacity available for the market. Please refer to the approved DA/ID CCM equation 9 and 10.